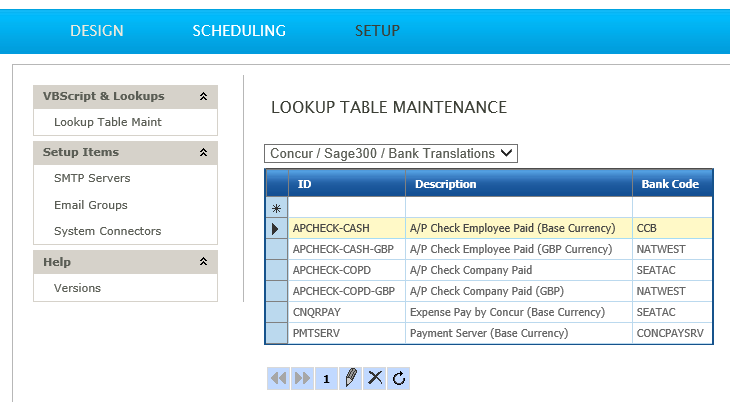

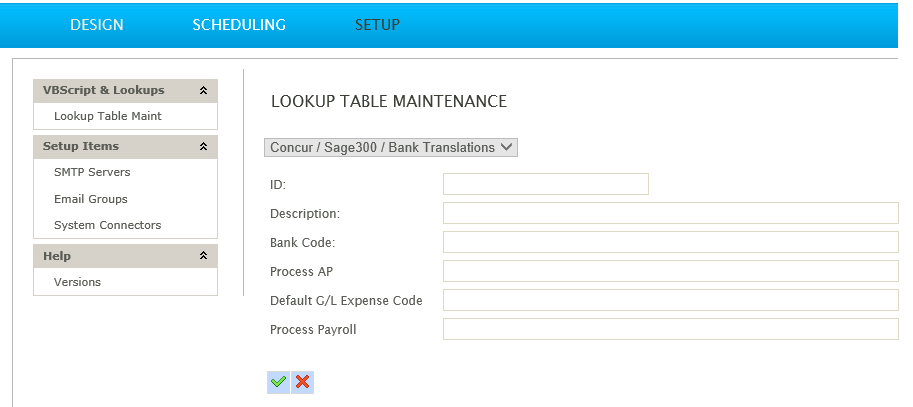

Bank Code translations

The Bank Translations provide the main control over how entries are posted from Concur to Sage300. Each payment type in Concur requires an entry in this table, and each entry specifies which modules the expenses are posted.

Example

Company Paid entries can be processed through the Accounts Payable Module, whereas Employee Paid expenses can be processed through the relevant Payroll module.

It is paramount that each is entry is edited, so entries are posted to the correct module, and to the correct bank account where appropriate.”

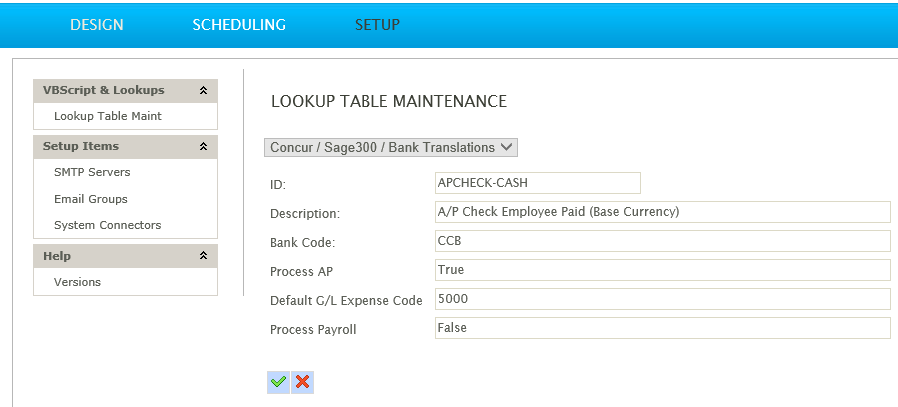

- Double click each lookup to edit:

- ID

- Refers to the payment type.

- Description

- Recognisable description of the setting.

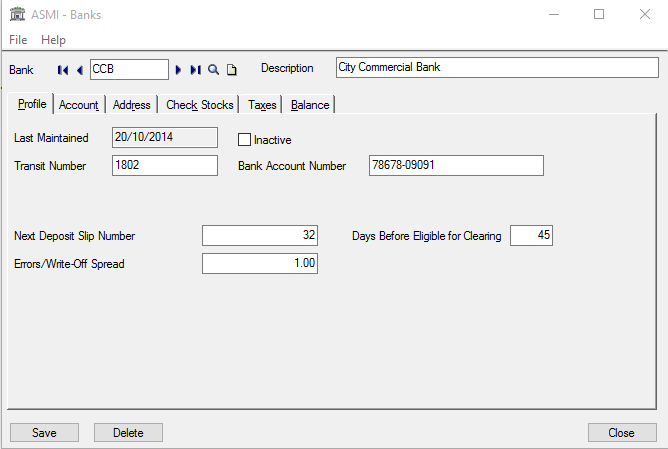

- Bank code

- The Bank Account code corresponding to Sage.

- Process AP

- True/False

- Designates whether an expense with this type will be processed through Accounts Payable or General ledger.

- Default Expense G/L Code

- Default G/L Account to post expenses if an expense has not been assigned within Concur.

- Process Payroll

- True/False

- Designates whether an expense with this type will be processed as an expense through the US or Canadian Payroll products. This setting applies only when an employee is owed by the company.

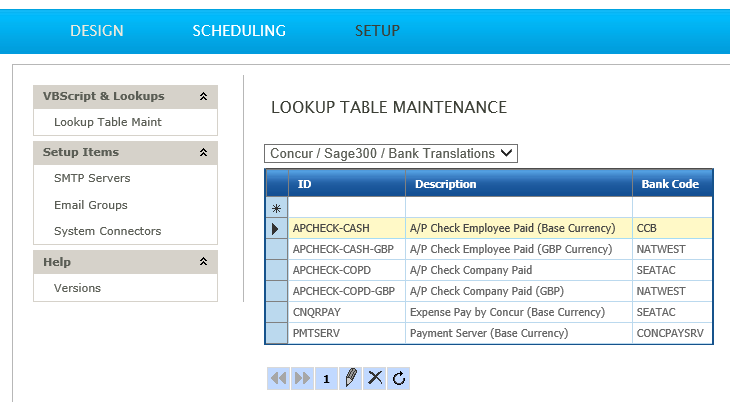

Additional Bank Translations

Additional Bank Translations may be required for additional company card payment types or when Multi-Currency is enabled.

To enter additional Bank Translations:

- Return to the Lookup Table Maintenance grid.

- Ensure that 'Concur /Sage300 / Bank Translations' is selected from the drop down.

- Double click the top row of the grid to create a new record.

- Edit the new record accordingly.

- Press the green tick to save.