File Export Configuration

Configure File Export function to ensure the correct data is available for IMan to correctly populate Sage.

IMan uses webservices to obtain the file, so there is no need to download the file from Concur.

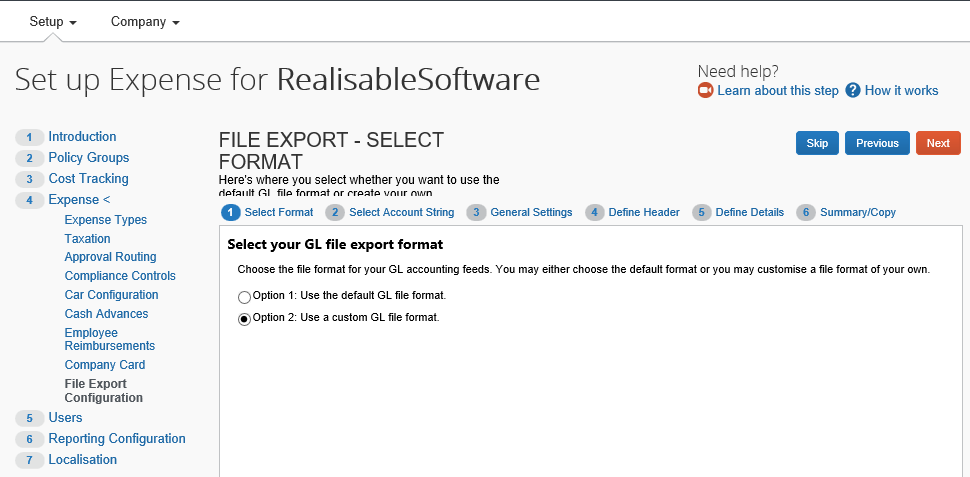

Select Format

- Select “Use a custom GL file format.”

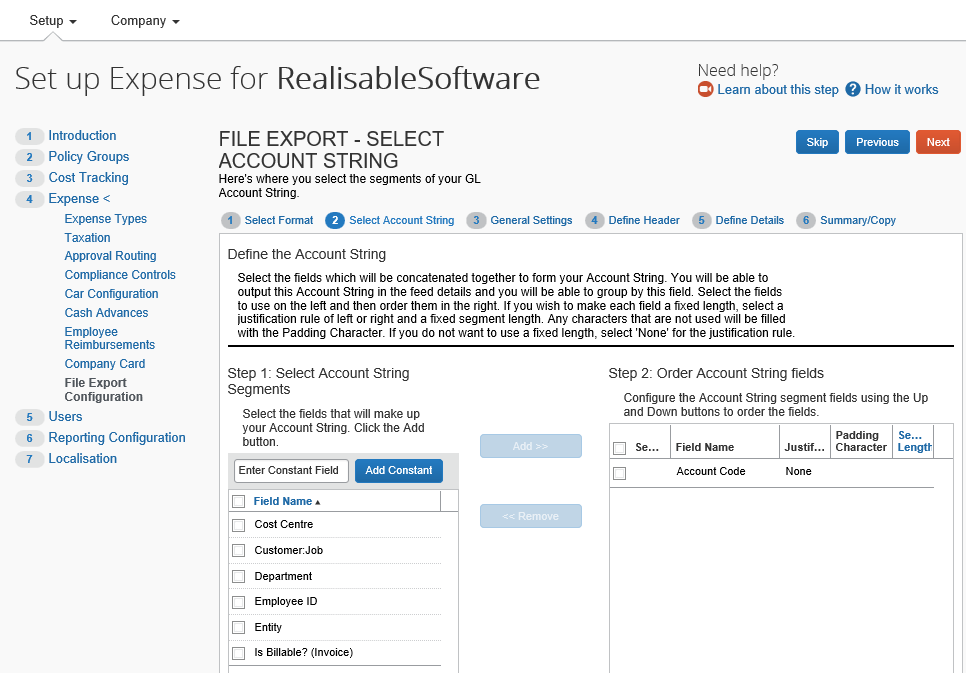

Account String

- It is recommended that only the account code field is selected.

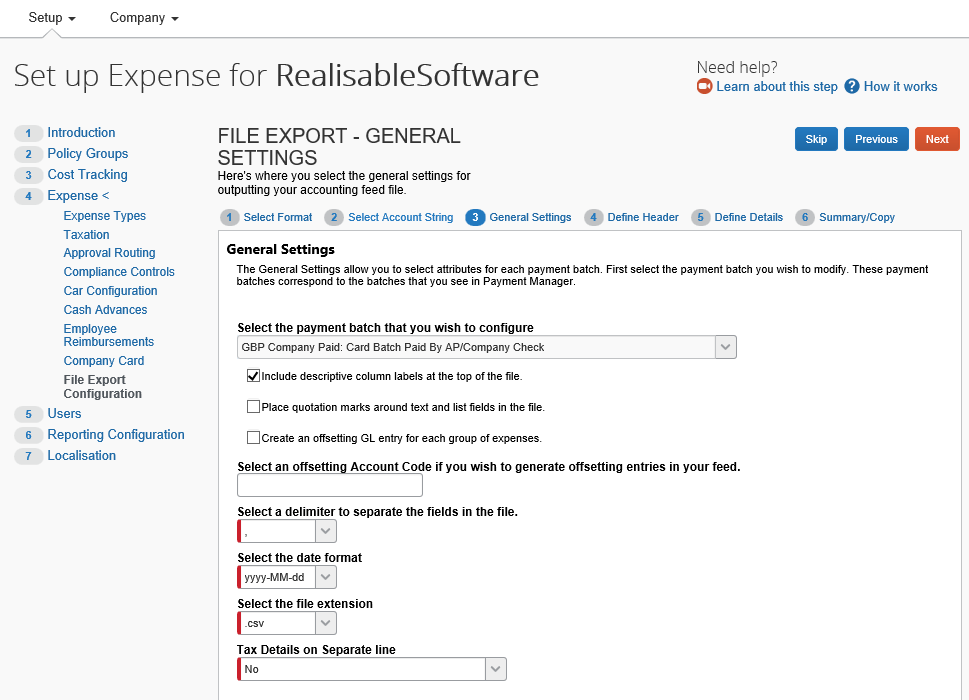

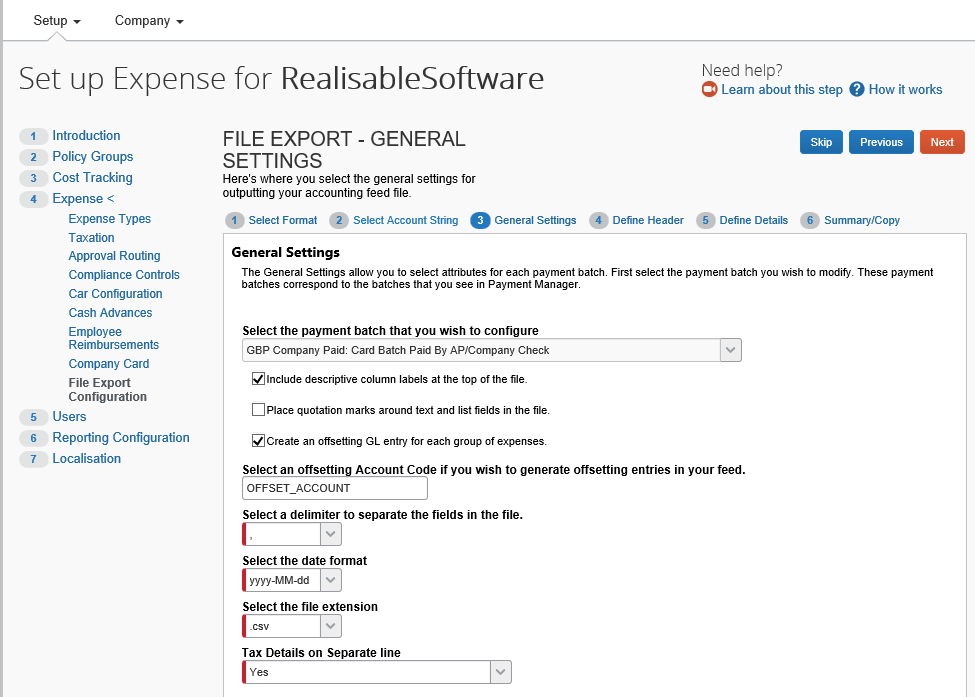

General Settings

- Include descriptive column labels at the top of the file.

- Delimiter must be a comma “,”

- Date format must be “yyyy-MM-dd”

- File Extension must be “.csv”

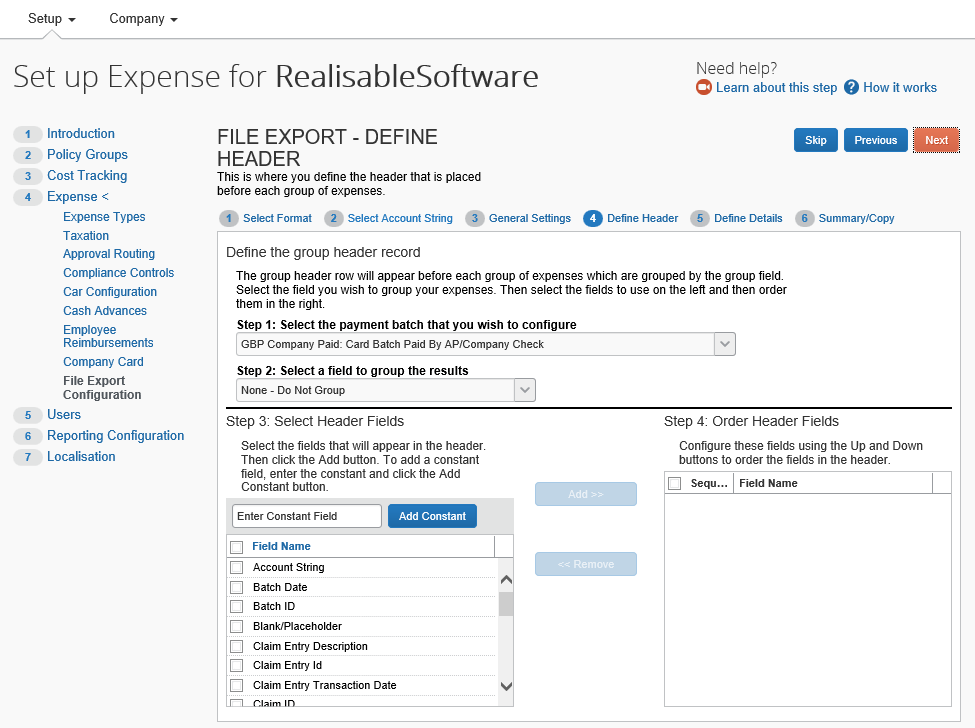

Define Header

- No Grouping

- No Header

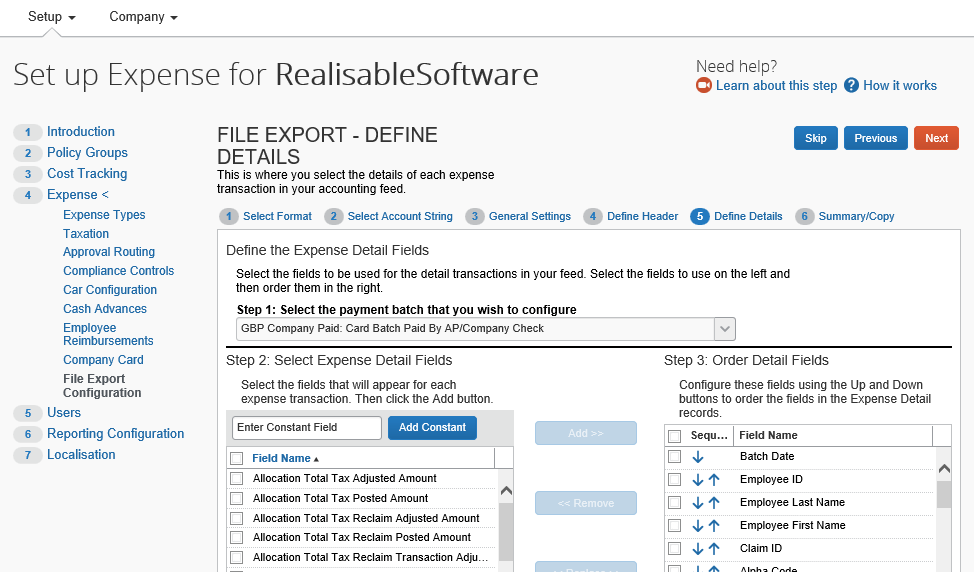

Fields Details Fields

The following fields are mandatory for correct importing of data.

- Account Code

- Alpha Code

- Amount Company Paid

- Amount Due Company

- Amount Due Employee

- Claim ID

- Claim Payment Reimbursement Type

- Employee First Name

- Employee ID

- Employee Last Name

- Payment Code

- Payment Confirmed Amount

- Reimbursement Method

- Tax Adjusted Posted Amount

- Tax Code

- Any other fields used to track costs should also be included in the file.

Warning: Some combination of fields (typically when too many fields are selected) will cause the accounting extract to fail. Where this is the case it is recommended to reset the configuration and begin again.

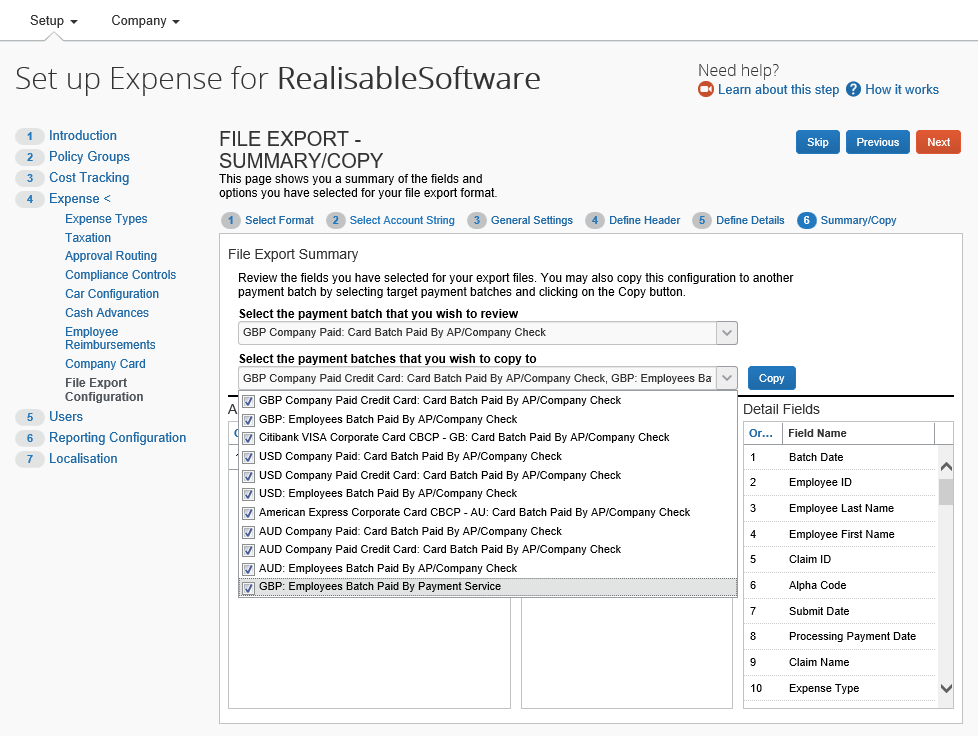

Summary/Copy

- If all expenses will be accounted for through Accounts Payable and/or Payroll modules, copy the configuration to each of the Payment Batch types.

- Please consult the following section if some (or all expenses) will be accounted through the G/L or Nominal ledgers.

General Ledger/Nominal Only Imports

- Create an offsetting GL entry for each group of expenses

- Enter an offsetting account.

- Enter Tax Details on separate line.

- When at the Copy/Summary step, copy the configuration to each of the Payment Batch types where G/L only imports will be used.