accounts receivable

- A/R Adjustments

- A/R Comment

- A/R Customer

- A/R Invoice

- A/R Invoice Print

- A/R Item (Setup)

- A/R National Accounts

- A/R Recurring Invoice

- A/R Receipt

- A/R Refund

- A/R ShipTo Address

- A/R Statement Print

A/R Adjustments

Views/Record Types Supported

All

Update

Insert only

Limitations

None

Writeback Fields

| AR0041.CNTBTCH | Batch Number |

| AR0041.CNTENTER | Batch Entry Count |

| AR0041.ENTRYTOT | Total of Entries |

| AR0042.CNTBTCH | Entry Batch Number |

| AR0042.CNTITEM | Entry Number |

Implementation Notes

Batch Posting

The resulting batch may be posted by setting the ‘Post Created Batch’ (POSTCREATEDBATCH) field to one of the following values.

|

Value |

Notes |

|---|---|

|

0 |

Do not post the batch. |

|

1 |

Post the batch if there are no errors during batch creation. |

|

2 |

Post the batch irrespective of any errors. The batch will only be posted if the Error Action has been set to either Reject Record or Continue; when set to Abort the batch will not be posted. |

A/R Invoice

Views/Record Types Supported

All

Update

Insert only

Limitations

None

Writeback Fields

| AR0031.CNTBTCH | Batch Number |

| AR0031.CNTINVCENT | Batch Entry Count |

| AR0031.AMTENTR | Batch Total |

| AR0032.CNTBTCH | Entry Batch Number |

| AR0032.CNTITEM | Entry Number |

| AR0032.IDINVC | Document Number (Set when is auto-numbered) |

| AR0033.CNTBTCH | Entry Detail Batch Number |

| AR0033.CNTITEM | Entry Detail Entry Number |

| AR0033.CNTLINE | Entry Detail Line Number |

Implementation Notes

Entry record can be either A/R Invoice Header (AR0032) or A/R Invoice Batch (AR0031).

Distributing Tax

Tax can be distributed using the invoice header over the detail lines as per the Distribute Tax button found on the Tax tab of the user interface. To distribute tax set the following fields with respective values:

|

Field |

Description |

Value |

|---|---|---|

|

SWMANLTX |

Tax Override |

1 |

|

DISTTAXES |

Distribute Taxes Over Details |

True |

Batch Posting

The resulting batch may be posted by setting the ‘Post Created Batch’ (POSTCREATEDBATCH) field to one of the following values.

|

Value |

Notes |

|---|---|

|

0 |

Do not post the batch. |

|

1 |

Post the batch if there are no errors during batch creation. |

|

2 |

Post the batch irrespective of any errors. The batch will only be posted if the Error Action has been set to either Reject Record or Continue; when set to Abort the batch will not be posted. |

Prepayments

Prepayment Made Against Invoice (SWPREPAY)

When True a prepayment will be made against the invoice. When a prepayment is made against the invoice the following fields are processed:

|

Field Id |

Name |

Description |

|---|---|---|

|

PPARBTCHAPPEND (Optional) |

Append Prepayment To Existing Batch |

Specifies if the prepayment should be appended to an existing open A/R Receipt Batch. If a batch cannot be found matching the criteria a new A/R Batch will be created.

|

|

PPBANKCODE (Mandatory) |

Bank Code |

The bank to which the deposit is made. |

|

PPARBTCHDESC (Optional) |

A/R Receipt Batch Description |

When not specified the A/R Receipt Batch Description defaults to: “A/R Invoice Prepayment” |

|

PPBANKCURN (Optional) |

Bank Currency |

The default batch currency. |

|

PPDEPSTNBR (Optional) |

Deposit Number |

|

|

PPDEPDATE (Optional) |

Deposit Date |

|

|

PPDEPCOMMENT (Optional) |

Deposit Comment |

|

|

PPDATERMIT (Optional) |

Receipt Date |

|

|

PPDATEBUS (Optional) |

Posting Date |

|

|

PPTEXTPAYOR (Optional) |

Payor |

|

|

PPTEXTRMIT (Optional) |

Entry Description |

|

|

PPTXTRMITREF (Optional) |

Entry Reference |

|

|

PPCODEPAYM (Optional) |

Payment Code |

|

|

PPIDRMIT (Optional) |

Check/Receipt No. |

|

|

PPBANKRATE (Optional) |

Bank Rate |

The Bank Rate |

|

PPCHECKDATE (Optional) |

Check Date |

The deposit date. |

|

PPAMTRMIT (Mandatory) |

Receipt Amount |

The receipt amount. |

|

PPCODECURNBC (Optional) |

Receipt Currency |

|

|

PPDATERATETC (Optional) |

Customer Rate |

|

|

PPDATERATETC (Optional) |

Customer Rate Date |

|

|

PPRATETYPETC (Optional) |

Customer Rate Type |

|

|

PPCHECKNUM (Optional) |

Check/Receipt Number |

This is a writeback field, but may also be specified. |

|

PPDOCNBR (Optional) |

Receipt Document Number |

Writeback field to capture A/R Prepayment Document Number |

Deleting Empty/Erroneous Batches

If an error occurs during the creation of a batch OR if the batch is empty i.e. has no entries, the batch can be deleted by setting the 'Delete Empty/Erroneous Batch' (DELEMPTYBATCH) to '1'.

|

Value |

Notes |

|---|---|

|

0 |

Do not delete the batch. |

|

1 |

Delete the batch. |

A/R Invoice Print

This allows A/R invoices & credit notes to be printed to either a local printer or exported to file.

Views/Record Types Supported

N/A

Update

Create only

Limitations

None

Writeback Fields

None

Implementation Notes

|

Field |

Description |

|---|---|

|

Print Invoice |

When set to true will print the report to the specified printer. |

|

Printer Name |

The name of the locally installed printer. The printer cannot be a network printer. |

|

Export File Path |

The file to export the report to. |

|

Invoice Form |

The Crystal Report form. |

|

Batch Number & Batch Entry |

When populated will print the invoice using the batch and entry numbers. |

|

Customer & Invoice |

When populated will print the invoice using customer and invoice numbers. |

A/R Recurring Invoice

Views/Record Types Supported

All

Update

Insert & Update

Limitations

None

Writeback Fields

| AR0047.CNTLINE | Line Number |

Implementation Notes

Taxes

Tax can be distributed using the invoice header over the detail lines as per the Distribute Tax button found on the Tax tab of the user interface. To distribute tax set the following fields with respective values:

|

Field |

Description |

Value |

|---|---|---|

|

SWMANLTX |

Tax Override |

1 |

|

DISTTAXES |

Distribute Taxes Over Details |

True |

Updating Recurring Invoices

When updating an existing recurring charge, set the Customer & Recurring Charge fields.

To update an existing line it is necessary to identify or matched to the line being updated. This is achieved by setting the either the CNTLINE or IDDISTCODE fields.

To control which should be used for matching the ‘Line Match Method’ (MATCHMTD) field controls how the lines are matched.

|

Field Id |

Line Match Method Value |

Notes |

|---|---|---|

|

Line Number (CNTLINE) (Default) |

0 |

The value may be obtained either at the time the Recurring Invoice is created, or via a lookup against the Recurring Charge Details. |

|

Distribution Code (IDDISTCODE) |

1 |

When matching by distribution code, ensure there are no duplicate distribution codes in the recurring charge. When duplicate distributions are present only the first one is updated. |

A/R Receipt

Views/Record Types Supported

All

Update

Insert only

Limitations

No Project and Job Costing Support

Writeback Fields

| AR0041.CNTBTCH | Batch Number |

| AR0041.CNTENTER | Batch Entry Count |

| AR0041.FUNCAMOUNT | Batch Functional Total |

| AR0042.CNTBTCH | Entry Batch Number |

| AR0042.CNTITEM | Entry Number |

| AR0042.DOCNBR | Document Number (Set when document is auto-numbered) |

Implementation Notes

All forms of receipts (Applied, Prepayment, Unapplied & Miscellaneous) may be created. To set the receipt type, change the AR0042.RMITTYPE field as per the AOM.

Batch Posting

The resulting batch may be posted by setting the ‘Post Created Batch’ (POSTCREATEDBATCH) field to one of the following values.

|

Value |

Notes |

|---|---|

|

0 |

Do not post the batch. |

|

1 |

Post the batch if are no errors during batch creation. |

|

2 |

Post the batch irrespective of any errors. The batch will only be posted if the Error Action has been set to either Reject Record or Continue; when set to Abort the batch will not be posted. |

Deleting Empty/Erroneous Batches

If an error occurs during the creation of a batch OR if the batch is empty i.e. has no entries, the batch can be deleted by setting the 'Delete Empty/Erroneous Batch' (DELEMPTYBATCH) to '1'.

|

Value |

Notes |

|---|---|

|

0 |

Do not delete the batch. |

|

1 |

Delete the batch. |

A/R Refund

Views/Record Types Supported

All

Update

Insert only

Limitations

No Project and Job Costing Support

Writeback Fields

| AR0140.CNTBTCH | Batch Number |

| AR0140.CNTENTER | Batch Entry Count |

| AR0140.ENTRYTOT | Total of Entries |

| AR0141.CNTBTCH | Entry Batch Number |

| AR0141.CNTITEM | Entry Number |

| AR0141.IDINVC | Document Number (Set when refund is auto-numbered) |

| AR0142.CNTBTCH | Entry Detail Batch Number |

| AR0142.CNTITEM | Entry Detail Entry Number |

| AR0142.CNTLINE | Entry Detail Line Number |

Implementation Notes

Entry record can be either A/R Refund Batch (AR0140) or A/R Refund Header (AR0141).

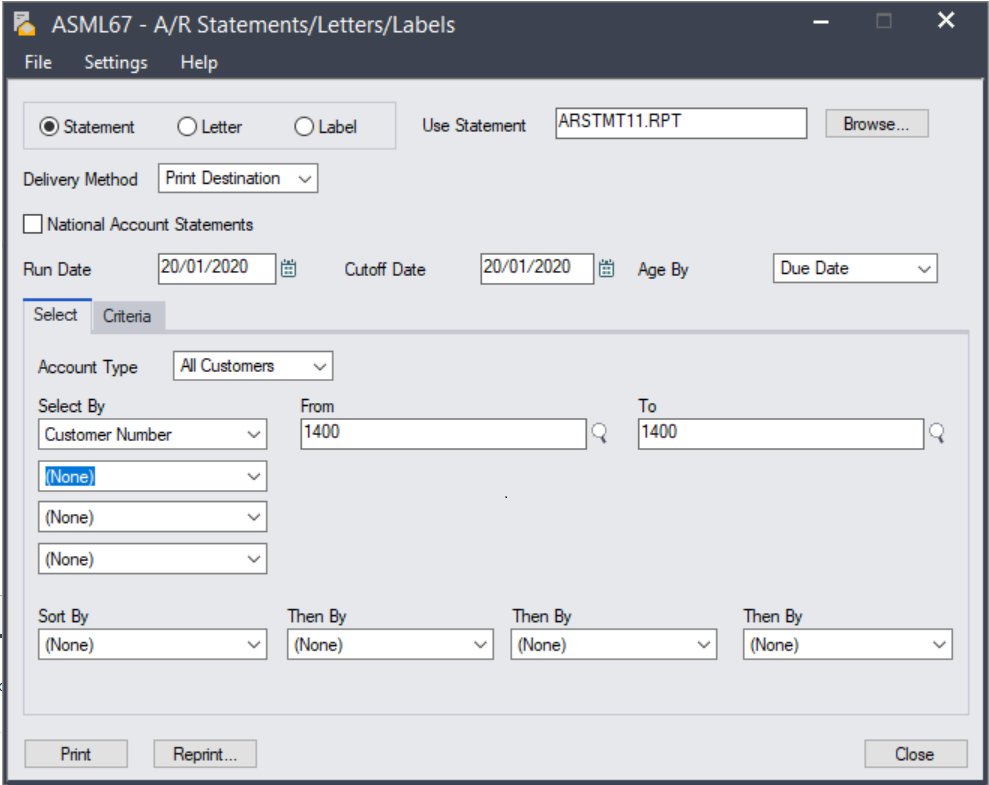

A/R Statement Print

This allows A/R Statements can be printed or exported.

Statements are generated one customer at a time, which is specified by the IMan dataset.

The statement print does not give you the possibility to print a range of statements like you can through the UI.

Views/Record Types Supported

N/A

Update

Create only

Limitations

Letter/Label printing is not supported.

Writeback Fields

None

Implementation Notes

|

Field |

Description |

|---|---|

|

Print Invoice |

When set to true will print the report to the specified printer. |

|

Printer Name |

The name of the locally installed printer. The printer cannot be a network printer. |

|

Export File Path |

The file to export the report to. |

|

Invoice Form |

The Crystal Report form. |

|

Customer |

The customer id (or national account) to print the statement for. |

|

Run Type |

Set to 0 for Customer Statements (default) and 1 for National Accounts. |

|

Remaining Fields |

Are used to specify the other parameters used to generate the statement. |